WhatsApp)

WhatsApp)

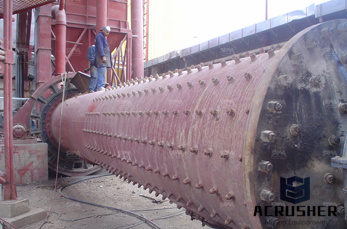

Bullock gold mining case study mirr chapter 8 case bullock gold mining answers grinding mill gold mobile crusher is the newly type of gold mining machine for gold crushing and it can eliminate the obstacles of the crushing places and circumstances and offer the .

Chapter 8 Case: Bullock Gold Mining Edition 8 Solutions. bullock gold mining mini case centrostampasrlit bullock gold mining case study seth bullock in How Bullock Gold Mining The payback period for Bullock Gold Mining in the Sample Data Mining Use Cases Payback Period Formula Examples Payback period is the time in which the initial cash outflow

Nov 12, 2019· Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company''s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined.

bullock gold mining case study answers corporate finance. Seth Bullock, the owner of Bullock Gold Mining, is assessing a brandnew cash cow in South Dakota. Dan Dority, the business''s geologist, has actually simply completed his analysis of the mine website. He has actually approximated that the mine would be efficient for 8 years, after which ...

Mar 28, 2016· CHAPTER CASE BULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company''s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined.

Question: CHAPTER CASE BULLOCK GOLD MINING Seth Bullock, The Owner Of Bullock Gold Mining, Is Evaluating A New Gold Mine In South Dakota. Dan Dority, The Company''s Geologist, Has Just Finished His Analysis Of The Mine Site. He Has Estimated That The Mine Would Be Productive For Eight Years, After Which The Gold Would Be Completely Mined.

CHAPTER CASE BULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company''s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined.

CHAPTER CASE BULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company''s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined.

Bullock Gold Mining Case Study Answers Corporate Finance. Bullock gold mining case study mirr chapter 8 case bullock gold mining answers grinding mill gold mobile crusher is the newly type of gold mining machine for gold crushing and it can eliminate the obstacles of the crushing places and circumstances and offer the high efficient and low cost project plants for the client

Chapter case bullock gold miningour company is a largescale heavy enterprise that taking heavy mining machinery manufactory as main products and integrated with scientific research production and marketing we are concentrating on producing and selling machines such as jaw crusher cone crusher hammer crusher ball mill sand maker mobile crushing plant.

Sep 16, 2018· The Bullock Gold Mining case can be analyzed by the use of Payback Period, NPV, IRR, and modified IRR. From the calculations in the appendix, all the above calculations show positive results to imply that the project is worth investing in. Therefore, the Ballock Gold mine is a viable project. References. Cornett, M., Adair, T., Nofsinger, J ...

Page 274 s chapter case bullock gold mining eth bullock, the owner of bullock gold mining, is evaluating a new gold mine in south dority, the company. Get Price; Mini Case Study Bullock Gold Mining Answer. Bullock gold mining case study answers.

Apr 18, 2013· Corporate Finance Case Study : Bullock Gold Mining 1. LOGOLOGOBullock Gold MiningCorporate Finance Case StudyUun Ainurrofiq Yoong Khai Hung Khatereh Azarnoor Aliakbar BahrpeymaJevgenijs Lesevs .

Question: CHAPTER CASE BULLOCK GOLD MINING Seth Bullock, The Owner Of Bullock Gold Mining, Is Evaluating A New Gold Mine In South Dakota. Dan Dority, The Company''s Geologist, Has Just Finished His Analysis Of The Mine Site. He Has Estimated That The Mine Would Be Productive For Eight Years, After Which The Gold Would Be Completely Mined.

Chapter 8 chapter case bullock gold mining chapter case bullock gold miningchapter 8 casebullock gold mining answersgrinding mill china gold mobile crusher is the newly type of goldmining machine for gold crushing and it caneliminate the obstacles of the crushing places and circumstances and offerthe high efficient and low cost project plants.

CHAPTER CASE BULLOCK GOLD MINING 1. Construct a spreadsheet to calculate the payback period, internal rate of return, modif rate of return, and net present value of the proposed mine.

Case Study On Mining In Goa Process Crusher. Bullock Gold Mining Case Solution. Chapter 8 case bullock gold mining answers grinding mill gold mobile crusher is the newly type of gold mining machine for gold crushing and it can eliminate the obstacles of the crushing places and circumstances and offer the high efficient and low cost project plants for the client.

Oct 17, 2017· This Case Is About BULLOCK GOLD MINING Get Your Bullock Gold Mining Case Solution at is the number 1 destination for getting the case studies analyzed.

Case III Chapter 8 Case,Bullock Gold Mining, page 274 is due this week. CHAPTER CASE. BULLOCK GOLD MINING. Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company''s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for ...

Sep 25, 2011· This is an explaination of Essentials of Corporate Finance Chapter 3 end of chapter case.

Chapter 9 Case Study Bullock Gold Mining 1. Construct a spreadsheet to calculate the payback period internal rate of return modified internal rate of return and net present value of the proposed mine. Based on the cash flows of the proposed investment the payback period will be between year 4 and year 5 more precisely in years. By dividing the ending balance of year 4

Chapter 9 Bullock Gold Mining Input area Year Cash flow 1 2 from BUSINESS 1111 at University of Texas, Dallas

CHAPTER CASE Bullock Gold Mining Sebo eth Bullock, the owner of Bullock Gold Mining, evaluating a new gold mine in South Dakota. Dan Dority, the company''s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined.

Question: CHAPTER +a 8 Net Present Value And Other Investment Criteria CHAPTER CASE Bullock Gold Mining Eth Bullock, The Owner Of Bullock Gold Mining, Is Evai Ating A New Gold Mine In South Dako''s. Aima Has Used The Estimates Provided By Dan To Dan Bolty, Deternine The Revenues That Could Be Expected From Doitdei E Company''s Geologist, Has Just Finishert His ...

WhatsApp)

WhatsApp)